종목토론카테고리

게시판버튼

게시글 내용

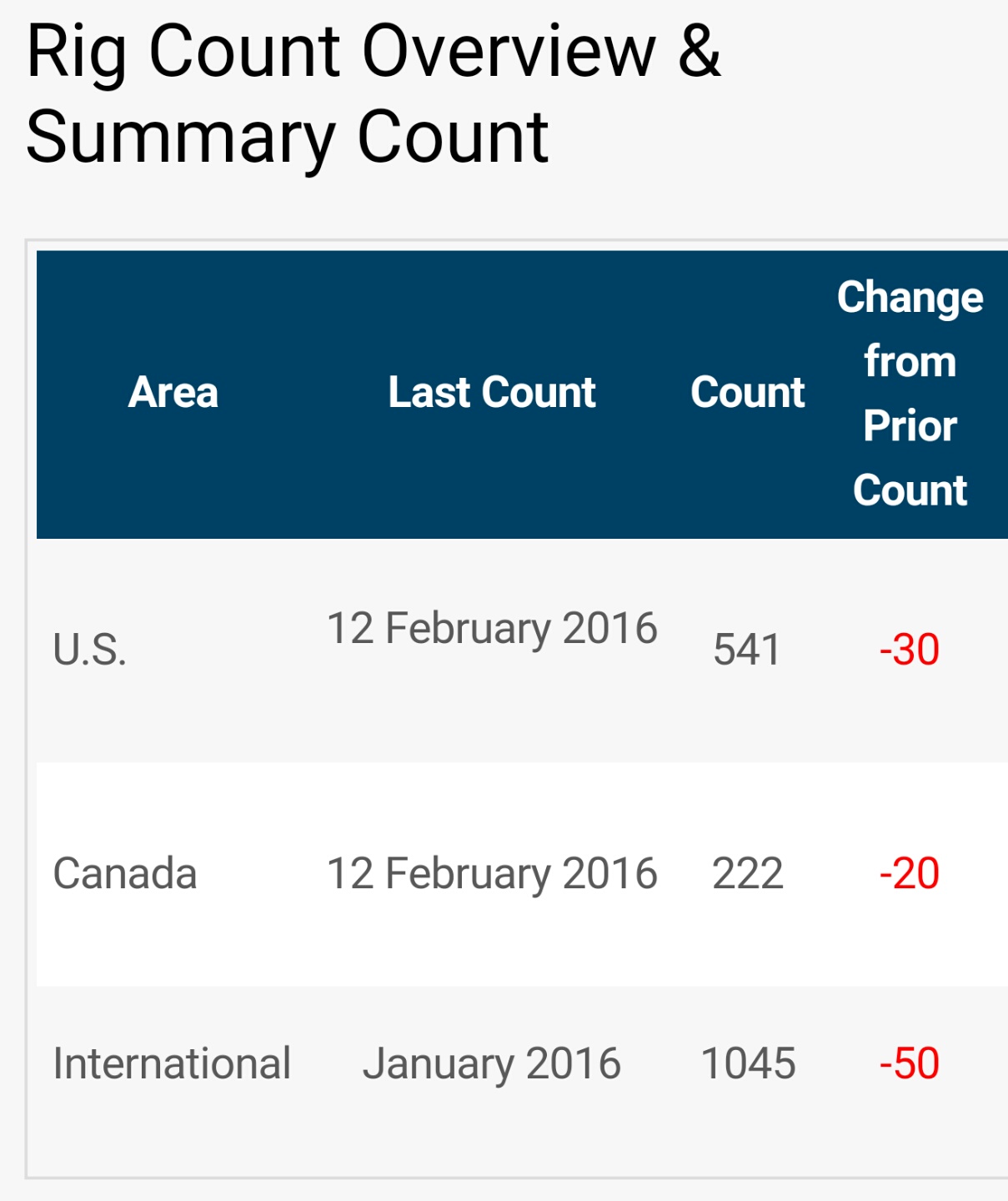

지난주에 이어 이번주에도 1주일새 미국 시추 리그가 오일 28개. 가스 2개. 토탈 30개가 팍 줄었습니다. 어제 아랍에미리트발 오일감산 뉴스로 국제유가 상승하고 있을 때 시추 리그의 큰폭 감소 소식이 상승 불씨에 석유를 확 뿌린 것 같습니다. 국제유가가 이렇게 춤을 추다보니 유가예측 이란게 전문가들도 힘들고 잘 맞지도 않습니다만 분명한건 저유가로 인해 석유기업들이 지금 투자를 않고 있고 시추 리그 수가 줄어드는 만큼 시차를 두고 생산량은 서서히 줄어드는 것은 분명 합니다. 지금은 넘의 나라 지역별 원유재고까지 일일이 신경쓸 필요가 없습니다. 워낙 변수가 많은데 그런자료들로 유가를 예측하고 베팅했다간 큰 손실만 납니다. Crude surges 10% to bounce off 12-year lows, amid rumors of OPEC cuts Crude surges 10% to bounce off 12-year lows, amid rumors of OPEC cuts Investing.com | Feb 12, 2016 07:27PM GMT WTI and Brent both soared by more than 10% on Friday to close above $29 Investing.com -- U.S. crude futures bounced from 12-year lows on Friday, completing one of their strongest one day moves on record, as investors digested reports that OPEC could be moving closer to convening for an emergency meeting that may result in sorely needed production cuts. On the New York Mercantile Exchange, WTI crude for March delivery traded between $26.96 and $29.66 a barrel, before settling at $29.27, up 3.03 or 11.56% on the day. With the sharp gains, U.S. crude halted a six-day losing streak during which oil prices crashed more than 16%, to fall to its lowest level since May, 2003. At Friday's session-highs, WTI crude surged more than 12%, enjoying its best one-day moves since February, 2009. On the Intercontinental Exchange (ICE), brent crude for April delivery wavered between $29.93 and $33.43 a barrel, before closing at $33.19, up 3.11 or 10.30% on the session. North Sea brent futures have responded to a massive four-day sell off from late last week by rallying more than $2 a barrel during its current three-day winning streak. Despite Friday's rebound, both the international and U.S. benchmarks are down considerably in 2016 by more than 10 and 20% respectively. Minutes after closing at its lowest in more than a decade on Thursday afternoon, U.S. crude prices received a boost following a report from the Wall Street Journal that OPEC members are preparing to cooperateon potential production cuts, according to United Arab Emirates' energy minister Suhail bin Mohammed al-Mazrouei. The UAE is regarded as a key cog for smaller OPEC members desperate for increases in oil prices, given its reluctance to slash output in recent months. While Al-Mazrouei indicated that the persistent downturn had already forced most Non-OPEC members to reduce output, he emphasized that a potential deal could not be achieved unless OPEC received "complete cooperation" of all of its member states. "Prices are not appropriate, I won't say for the majority only, but for all producers," Al-Mazrouei told Sky News Arabia. Any deal requires the approval of Saudi Arabia, the world's largest exporter. Earlier this week, OPEC said in its monthly Oil Market Report that it increased production by 131,000 barrels per day to 32.33 million bpd in January, driven by increases from Saudi Arabia, Iraq, Iran and Nigeria. Output in Saudi Arabia rose by 44,000 bpd to 10.091 million bpd, near all-time record highs. Over the last 15 months oil prices have plummeted more than 60% since OPEC rattled the energy industry with a strategic decision to leave its production ceiling above 30 million barrels per day at a meeting in November, 2014. The tactic triggered a prolonged battle between OPEC and U.S. shale producers for market share, resulting in a glut of oversupply on global energy markets. Producers in the U.S. also stand to benefit tremendously from a production cap. On Wednesday, the U.S. Energy Information Administration reported that stockpiles at the Cushing Oil Hub rose by 523,000 barrels to 64.7 million last week, moving closer to full capacity. Cushing, the main delivery point for NYMEX oil, reaches its storage limit at 73 million barrels. The U.S. Dollar Index, which measures the strength of the greenback versus a basket of six other major currencies, gained more than 0.45% to an intraday high of 96.25. Since the FOMC released its latest monetary policy statement on Jan. 27, the dollar has fallen by approximately 4%. Dollar-denominated commodities such as crude become more expensive for foreign purchasers when the dollar appreciates.

게시글 찬성/반대

- 4추천

- 0반대

내 아이디와 비밀번호가 유출되었다? 자세히보기 →

운영배심원의견

운영배심원의견이란

운영배심원 의견이란?

게시판 활동 내용에 따라 매월 새롭게 선정되는

운영배심원(10인 이하)이 의견을 행사할 수 있습니다.

운영배심원 4인이 글 내리기에 의견을 행사하게 되면

해당 글의 추천수와 반대수를 비교하여 반대수가

추천수를 넘어서는 경우에는 해당 글이 블라인드 처리

됩니다.

운영배심원(10인 이하)이 의견을 행사할 수 있습니다.

운영배심원 4인이 글 내리기에 의견을 행사하게 되면

해당 글의 추천수와 반대수를 비교하여 반대수가

추천수를 넘어서는 경우에는 해당 글이 블라인드 처리

됩니다.

댓글목록