종목토론카테고리

게시판버튼

게시글 내용

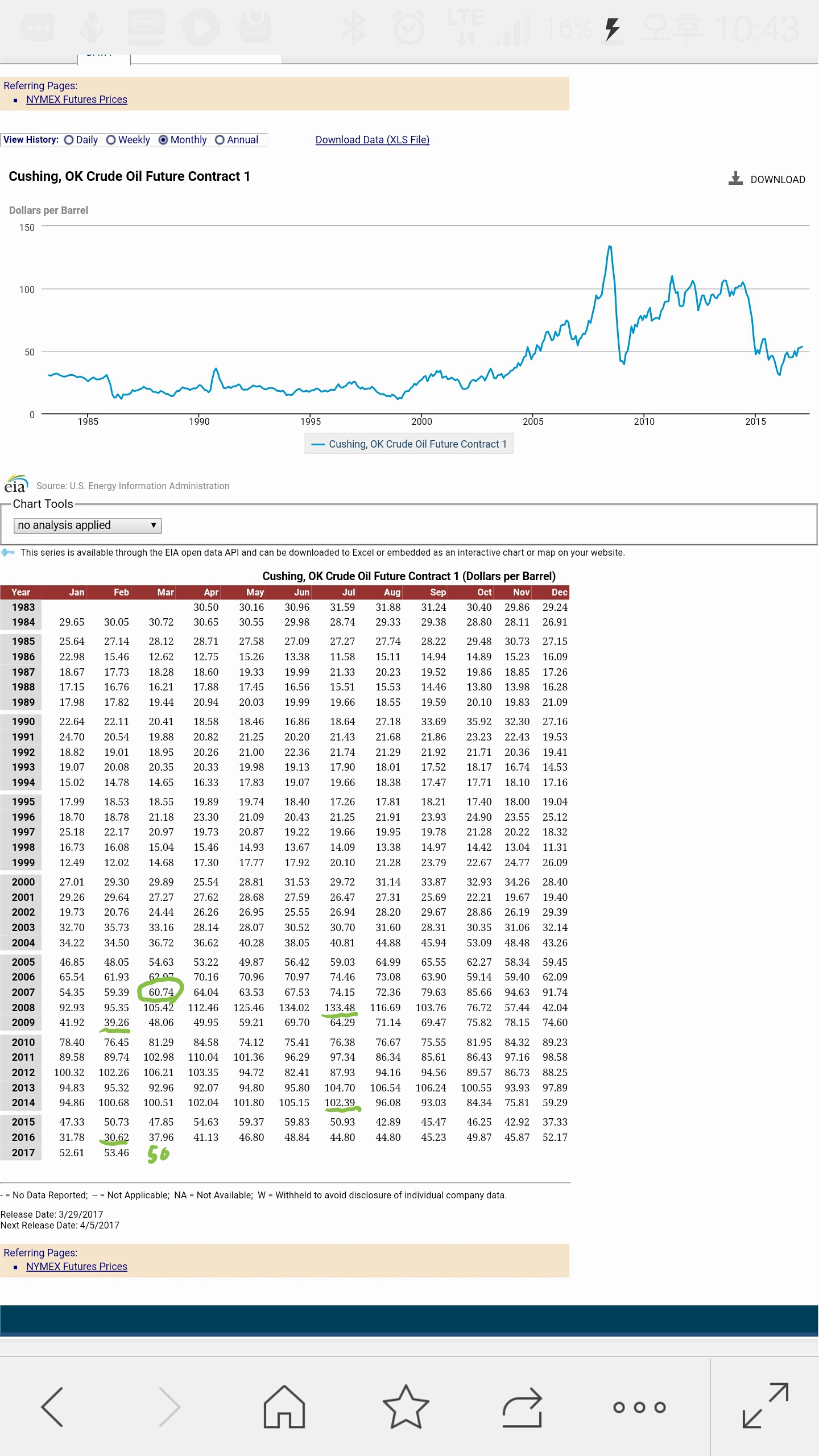

This year marks a new period of oil market management by leading oil producers who put together in late 2016 the most comprehensive agreement to limit oil output seen since 2009. The reason was to ensure that oil prices were stabilised to avoid economic dislocation in producing countries and provide a platform for gradual growth. The agreement brought to an end a two-year free-market window where producers competed to secure outlets for their oil.

This agreement provides the backdrop to the IEA's latest five-year oil market forecast, which was renamed Market Report Series: Oil 2017 (formerly known as the Medium-Term Oil Market Report). While we cannot know how long the deal will last, it provides clear trends to guide our view of the next five years.

- Oil demand is expected to grow strongly at least to 2022 with the main developing economies leading the way.

- The need for more production capacity becomes apparent by the end of the decade, even if supply appears plentiful today.

- It is not clear that upstream projects will be completed in time given the unprecedented two-year fall in investment in 2015 and 2016 although majorreductions in costs will help.

- There is a risk of prices rising more sharply by 2022 if the spare production cushion is eroded.

The Oil 2017 report, which provides market analysis and forecasts to 2022, sets the scene for what promises to be a transformative period in the history of oil

게시글 찬성/반대

- 0추천

- 0반대

내 아이디와 비밀번호가 유출되었다? 자세히보기 →

운영배심원의견

운영배심원의견이란

운영배심원 의견이란?

게시판 활동 내용에 따라 매월 새롭게 선정되는

운영배심원(10인 이하)이 의견을 행사할 수 있습니다.

운영배심원 4인이 글 내리기에 의견을 행사하게 되면

해당 글의 추천수와 반대수를 비교하여 반대수가

추천수를 넘어서는 경우에는 해당 글이 블라인드 처리

됩니다.

운영배심원(10인 이하)이 의견을 행사할 수 있습니다.

운영배심원 4인이 글 내리기에 의견을 행사하게 되면

해당 글의 추천수와 반대수를 비교하여 반대수가

추천수를 넘어서는 경우에는 해당 글이 블라인드 처리

됩니다.

댓글목록